Recent Articles

ARM vs 30-Year Fixed: How to Choose the Right Mortgage for Your Timeline

The 30-year fixed mortgage is often seen as the safest option, but it isn’t always the most efficient choice. For buyers who expect to move or refinance within a few years, an adjustable-rate mortgage (ARM) can offer lower initial rates and meaningful savings. Understanding how long you realistically plan to keep the loan is the key to choosing the right strategy.

Is Refinancing Your Mortgage the Right Move?

Find out if refinancing is right for you.

Housing Affordability in 2026: Why Rates Are not the Only Factor

Learn about home affordability factors with examples nationwide.

Loyalty to Your Bank? Even With Your Home-Loan?

Decided whether you are should use your bank or a mortgage broker?

Refinancing Your Vancouver, WA Home: It’s About More Than the Rate

When most Vancouver homeowners hear the word refinance, they immediately think one thing: “Can I get a lower interest rate?”

BIG NEWS: Mortgage Rates Are at Their Lowest Level in Years—What That Means for You

Find out what this rate drop means to you for buying a new home.

Mortgage Rates, QE, and Market Volatility: Separating Headlines from Reality

Mortgage rates don’t move on headlines — they move on inflation, Treasury yields, and investor demand. This breakdown explains how Quantitative Easing actually worked, why today’s $200B MBS purchases are not the same thing, and what current market volatility really means for buyers and homeowners.

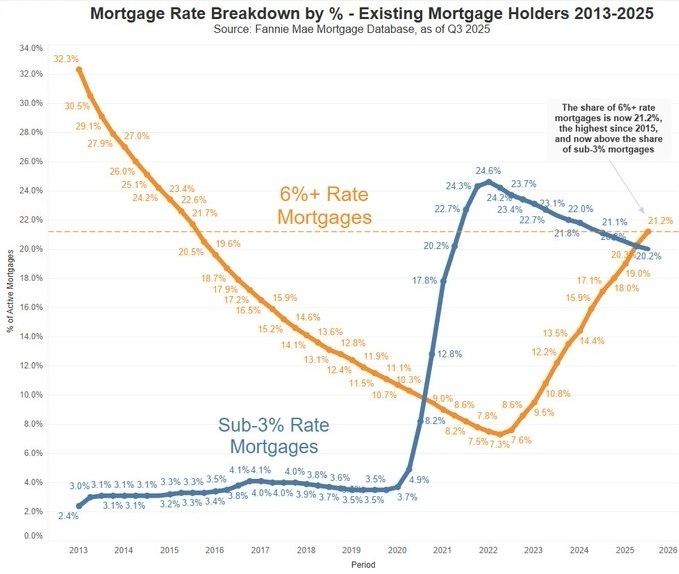

Lock-in Effect: Something big just happened in the U.S. Housing Market

Find out what the experts are anticipating for 2026 housing

Vancouver, WA Mortgage Rates Update: Holiday Week Keeps Rates Near 2-Month Lows

December 30, 2025 As we wrap up the final week of the year, mortgage rates in Vancouver, WA and throughout Southwest Washington remain near their lowest levels in almost two months. If the market felt unusually quiet over the holidays, that’s normal—and expected. Late December is known for holiday trading, a period when fewer investors are active in the bond market. Since mortgage rates are directly tied to bonds, lighter trading often results in slow, sideways movement rather than big swings.